Use of the term "Tax Cheat"

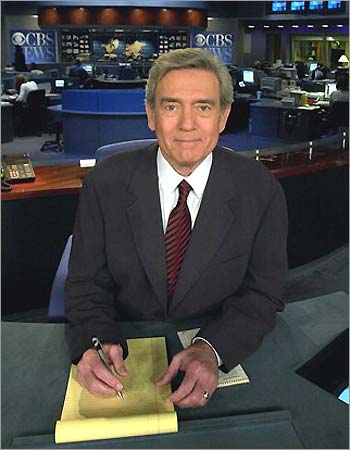

Alan S. Chartock

Dear Mr. Weaver,

Concerning Mohawk Valley blog which today discusses e-mails between Times-Union columnist Mark McGuire and myself dealing with WAMC, Alan Chartock, and an Income Tax Evasion Scheme.

Please note the oath printed prominently above the signature panel on IRS Form 990 - "Return of Organization Exempt from Income Tax". It reads: "Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete."

SEE: http://www.wamc.net/WAMC990-Sign.html

You state: "I would not go to the extreme that Heller does in calling Alan Chartock a tax cheat. The fact that he signs tax returns doesn‘t mean he reads them. That may not legally excuse him from responsibility for any errors in returns, but it doesn’t necessarily make him a cheat."

Sorry Mr. Weaver, but words mean something, most especially the words in a signed oath to IRS. The fact that Mr. Chartock is chief executive officer of a tax-exempt charity, and signs that charity's annual IRS return means that he better read that return -- every line of it! Otherwise, what is his purpose as the salaried $150K per year CEO of the organization?

Pardon me if I am less than sympathetic concerning any notion that this CEO, at the helm of this multi-million dollar tax-exempt org for more than twenty years (and who is acknowledged by friend and foe alike to be the ultimate micro-manager), would somehow not know the IRS rules governing how executive compensation at tax-exempts is to be accounted for, including how fringe benefits paid to org officials are to be calculated and reported to Uncle Sam.

At minimum, Mr. Chartock has got to suspect that somebody was paying for those new WAMC cars he's been driving these past twenty years, and that somebody was footing the bill for his chauffeur, for his use of furnished intown hideaways, and for his myriad other org perks so delightfully within easy reach these many oh-so-flush years at the helm.

Calling Alan Chartock a "tax cheat" isn't extreme, it is calling a spade, "a spade!"

G. M. Heller, editor

WAMC Northeast PIRATE Network

ALSO SEE: "TAX CHEAT! - How Alan Chartock conspired with WAMC to avoid paying IRS."

Labels: Alan Chartock, Albany, executive compensation, fringe benefits, media, public radio, WAMC

®/™

®/™